These 7 States Have No Income Tax

Wow! No Income Tax?

There was a dream. A dream of living tax free. Alas, its just a dream. The average home owning American family will pay roughly 30% of its income to federal, state and sales tax per year. Thirty cents of each dollar you make goes immediately out the door. I know this, because I pay taxes...and did some reading over at TaxFoundation.org. This 30%, of course, is before applying any tax breaks and credits. It has been this way for many years, so you wonder why its such a huge topic during political season if nothing really changes. Anyway, I thought I'd put a list together of the states with no income tax.

- Alaska - Alaska doesn’t tax its denizens on income, and it doesn’t have a sales tax either. In fact, Alaska pays you to live there. Supplementing income and sales tax with petroleum revenues, residents receive a share of the state’s oil and gas royalties, which reached nearly $2,000 in 2014.

- Florida - A favorite tourist destination for many, Florida gets revenue from sales tax and a higher than average property tax. Tax breaks for retired and elderly folks are also available.

- Nevada – Nevada, Las Vegas in particular, is the world capital for gaming and gambling. The state derives the majority of its income from gambling and sales tax.

- South Dakota – Home of the Badlands. This state derives its revenue from a low 4% sales tax coupled with a use tax.

- Texas – The Lone Star state gets its money from sales tax and oil and gas production royalties.

- Washington – The only state named after a president and AKA “The Evergreen State”. Residents here deal with a high sales tax and high gasoline tax.

- Wyoming – There is no income tax and no corporate income tax. Wyoming gets its money from coal mining, mainly, along with property taxes.

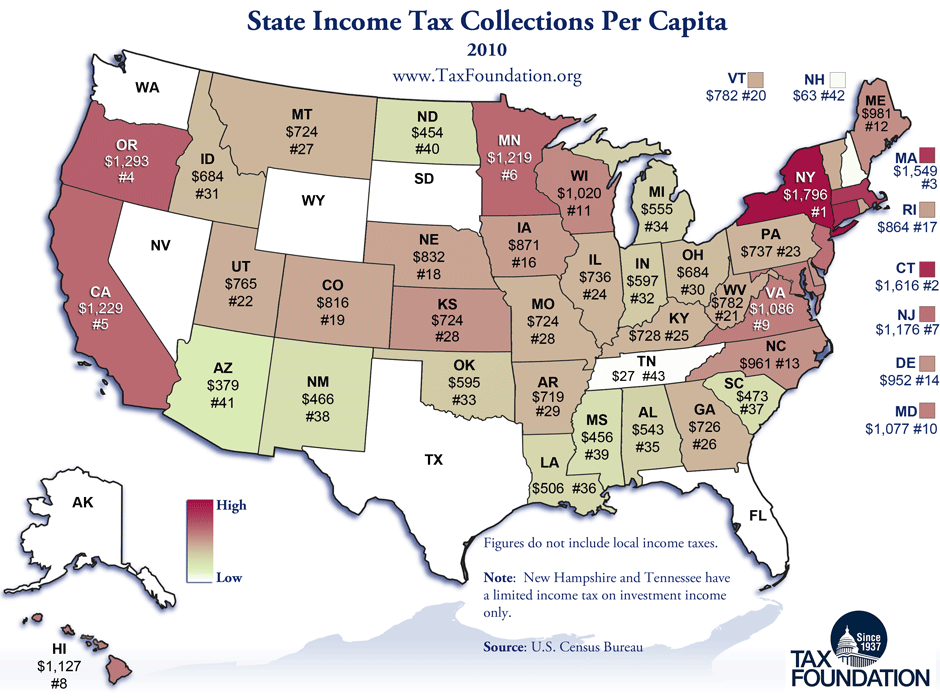

- New Hampshire and Tennessee do not tax wages, however, they do tax income from investments such as dividends and interest. This is not ideal for retirees who have worked hard building a retirement portfolio.

There is no hard evidence showing that people living in states with no income tax have a higher quality of life then others. Simply put, your state needs money to operate. Public services, that many take for granted are paid for from revenue generated by taxing residents. What those services are and how much of them that are provided are "normally" up to the voting public.

One of the key tenets that Warren Buffett uses when evaluating an investment is management. Can they get the job done? Are they honest with shareholders, and are they greedy? (In a nutshell.) If you were looking to invest in your state or city based on its leadership...would you invest? You may find out why your taxes are so high.

What are your thoughts on state income tax?

If your state eliminated personal income tax, how would it supplement that income?

Would you be in favor of higher property and sales tax vs income tax?

Should the next politician you vote for have a better understanding of budgeting and finance?