Death of The Dollar

Or Redefining Value

Article 1, Section 8 of the Constitution - Clause 1. The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States;

Article 1, Section 8 of the Constitution - Clause 5. To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures;

According to the above, only Congress has the power to control our money.

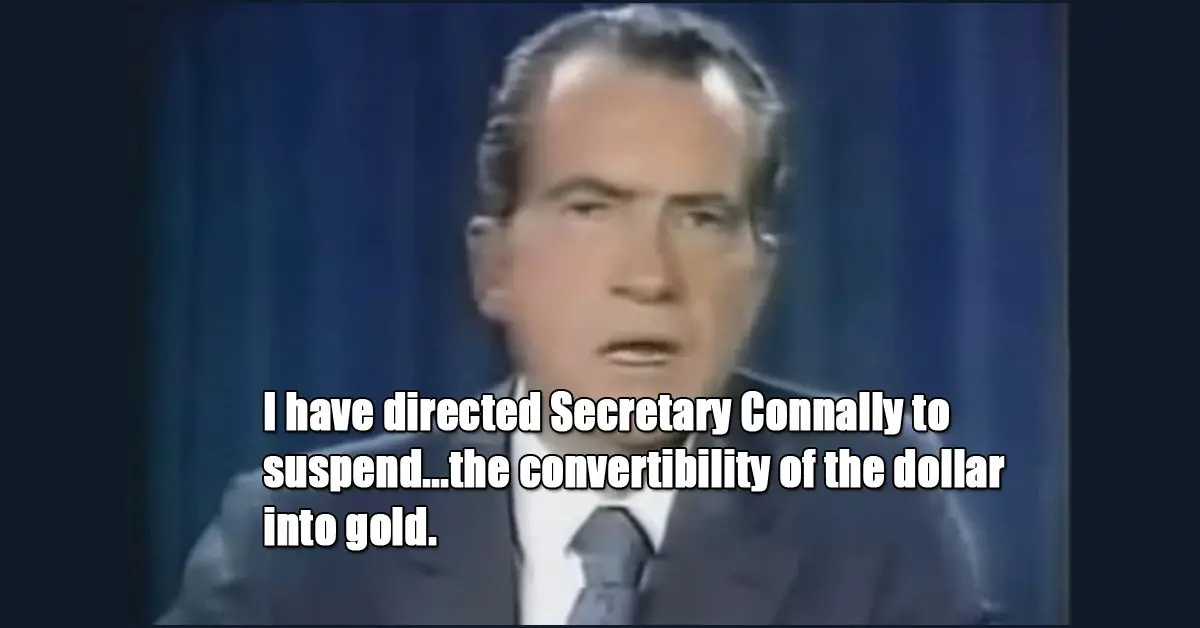

In 1971, President Nixon delivered the final blow to the gold standard marking one of the most impactful economic events in modern history. And so the era of fiat currency began. This event is referred to as the "Nixon Shock". Watch this monumental event unfold below:

This move probably saved the United States from emptying its gold coffers as foreign countries attempted to convert their US currency for gold. Ultimately, the US would most likely have defaulted on these redemptions if the demand was too great.

Proponents of the gold standard argue it provides long-term economic stability and growth, prevents inflation, and would reduce the size of government. They say a gold standard would restrict the ability of government to print money at will, run up large deficits, and increase the national debt. They say the economy has historically performed best under a gold standard.

Opponents argue a gold standard would create economic instability, spur periodic economic deflation and contraction, and hamper government's ability to stimulate the economy and reduce unemployment during recessions and financial crises. They say returning to a gold standard would be extremely difficult given the scarcity of gold and could severely harm the already fragile US economy. http://gold-standard.procon.org/#background

Could this just be part of a natural economic evolution? Throughout history, there have been many forms of currency, from bartering, precious metals and paper money. Technology has also had a great impact on how we pay for goods and services. Look at virtual money and cryptocurrency for example, such as Bitcoin. As society shifts and changes, so will economic theory. Some practices will work, and others will not. How do you think we will pay for goods and services 100 years from now?

Since its founding in 1776, the United States has had a variety of monetary systems including bimetallic systems where the dollar was backed by both gold and silver (1792-1862), a fiat monetary system (1862-1879), a full gold standard (1879-1933), and a partial gold standard (1933-1971). From 1971 to present the United States has been on a fiat monetary standard. [71]

Today, people rarely carry cash opting for electronic transactions. Electronic transaction are definitely more convenient. And along with the electronic era comes the redefining of value, or wealth. The worth of a person (in terms of monetary wealth) can be measured in credit worthiness and the digits in their bank accounts.

If fiat money isn't backed by a physical commodity, what is is backed by? In reality, one could argue that the strength of a fiat monetary system is backed by the government's ability to enforce the monetary policy. Globally, this would mean military might. This could be an underlying reason for much of today's military action.

If #SHTF and you found your fiat money digits worthless, would a stock pile of gold really be useful to you? What would you stockpile as a valuable commodity?

Consider this article a digital representation of my 2 cents.

Helpful Links:

Covert Banking System Used By The 1% For Financial Preparedness

Mises Institute Austrian School Of Economics